Banking 4.0 can be defined as the foundation of creative destruction that came through fintech companies, transitioning innovation, and traditional retail banks reorganizing their business models on new-age digital principles of platforms, apps, data intelligence, and embedded finance. This radical reordering brings a promise of platform-based banking to deliver experience-driven customer satisfaction through the optimum channel.

CIBC, the Canadian bank, for instance, has seen customer acquisition rates in three primary lines of business increase by 65% due largely to personalization efforts, a Capgemini report suggests. In the present financial ecosystem, hyper-personalized and growth-oriented digital environment, the competition for retail banks lies in customer trust, delivery channels, and data.

“Bank 4.0 is essentially embedded, ubiquitous banking built into the world around us through technology layer,” says Brett King, a global best-selling author, and a FinTech futurist, in his statement to Economic Times. Hence, banking 4.0 is essentially about shifting the financial service orbit by demolishing long-standing practices and experimenting with that which hasn’t been done yet.

At the heart of this transformation are today’s chief marketing officers (CMOs) and chief information officers (CIOs) who are also evolving in their role as chief customer strategists. This insight is for such new-defined roles in the retail banking sector that are trying to leverage technology to orchestrate unique customer experiences by coordinating technology, compliance, and data. Leaders who’re aiming at breaking data silos and ensuring that banks of the present finance ecosystem have capabilities to deliver real-time data-driven experiences will find our insight useful as we explain how banks can deliver value now, and what they can learn from fintech companies.

Why Banks Must Move From Status Quo?

In Brett King’s book entitled Bank 4.0: Banking everywhere, never at a bank, the description says that in 30-50 years when cash is gone, cards are gone and all vestiges of the traditional banking system have been re-engineered in real-time, what exactly will a bank look like? How will we reimagine a bank account, identity, value, assets, and investments?

“Banks have historically focused on capturing value and have forgotten about customer experience. Capturing value and profit is not contradictory if a bank focuses on long-term customer relationships,” says Alexander Weber, Chief Growth Officer of a German neobank.

95% of banking executives in The World Retail Banking Report highlight that legacy systems and outdated core banking modules inhibit efforts to optimize data- and customer-centric growth strategies.

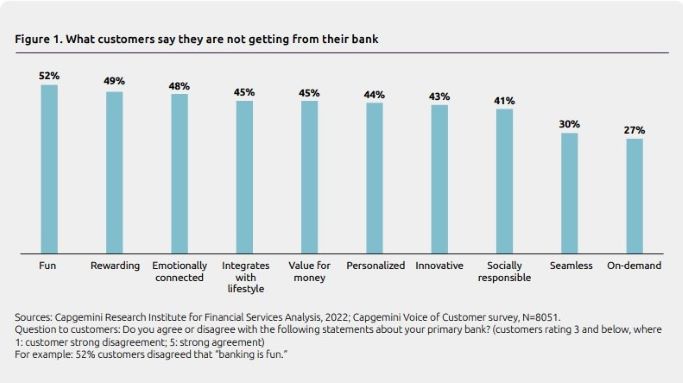

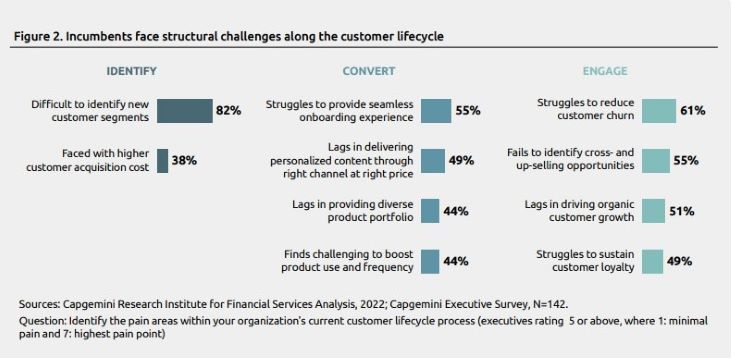

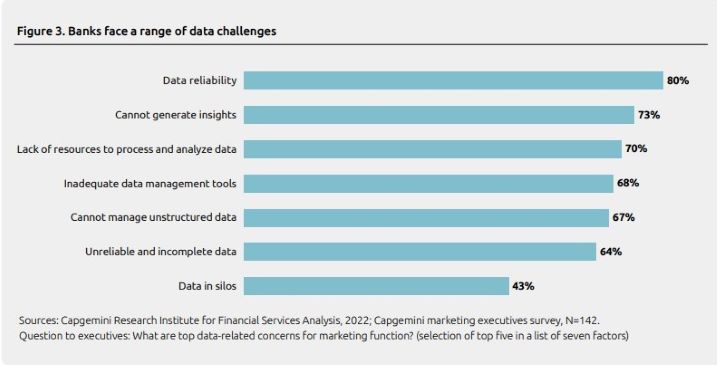

Evolving consumer tastes, a hyper-competitive landscape, and increasing regulatory scrutiny around data usage among some other factors (Fig. 1) are critical present contests that challenge banks in their abilities to digitally grow and evolve. The report also highlights structural challenges across the customer lifecycle (Fig. 2) and data challenges (Fig. 3) that incumbent banking institutions face.

It is on the lines of these pain points that incumbent banking institutions can compete in the fintech environment with a vision of futuristic banking 4.0 and move from the status quo.

Bank 4.0: A 4-Pronged Vision of Future Banking

The last two years have been quintessential in pushing the Banking, financial services, and insurance (BFSI) sector faster into the future. With the penetration of fintech companies as we move forward, financial services will be entirely driven by virtual facilities through platform-based models, cloud data storage, blockchain technology, digital channels, and other futuristic changes. Comparing the customer acquisition cost between digital and branch shows that the former has a cost of $5 per customer, while the latter has a cost of about $350 per customer. So, the digital acquisition cost of customers is another modality that’s driving the future of retail banking towards Bank 4.0.

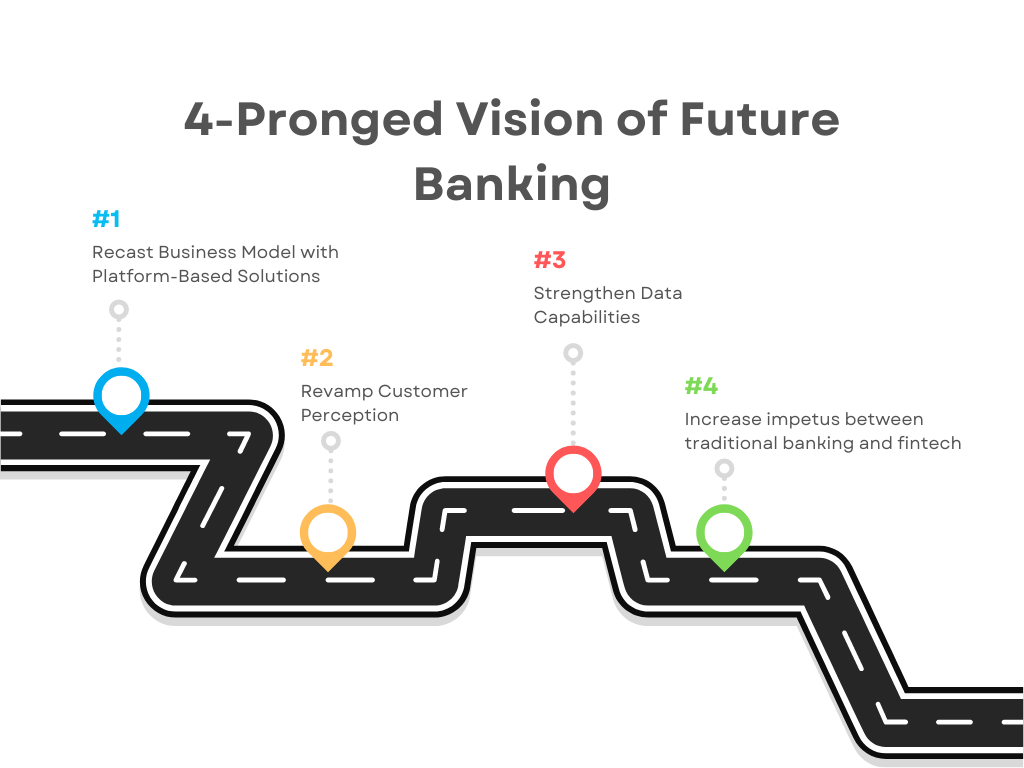

In the section below we explain a 4-pronged vision of how Banking 4.0 will unlock hyper-personalized engagement and drive revenues for traditional working retail banks.

The banking 4.0 vision should include recasting the business model with platform-based solutions, revamping customer perception, strengthening data capabilities, and increasing impetus between fintech and traditional banking (Fig. 4)

Recast Business Model with Platform-Based Solutions

Bank executives and customers fall in a similar bracket of expectations from the distribution channel. About 80% of both groups continue to view the website as a critical point of interaction. Mobile apps were cited by 77% of consumers, compared to 91% of executives, while branches were valued more by customers (75%) than executives (58%) in the survey done for The World Retail Banking Report 2022.

Platform-based products and services are promising for filling capacity holes and expanding retail banking revenue. However, banks are still at the cusp of technological reforms, and the executives struggle with cannibalizing products through ecosystem partners, preventing brand dilution, and maintaining ecosystem exclusivity for partners.

While new fintech players can accelerate customers’ expectations around the convenience, transparency, and speed of digital products and services, banks still have a few dominant areas where they can respond to position themselves for the future.

Revamp Customer Perception

Creating a positive brand perception on the grounds of low latency, and low friction, with an element of experience design, and ZeroOps is needed to redefine and revamp customer perception. Bank 4.0 is about capturing value by introducing relevant and low-priced innovative products, enhancing API and cloud capabilities, and strengthening internal processes for frictionless omnichannel experiences.

To change customer perception, the following recommendations can work well-

- Engage customers through VR/AR immersive experience

- Reinforce the commitment of the brand towards green banking by integrating ESG parameters into banking products

- Embrace models that bundle financial service, and non-FS together

- Drive collaboration and co-innovation to expand the banking product portfolio

- Embrace cloud and APIs for a robust digital foundation to improve internal processes

- Synchronize digital and physical channels to shift from multi-channel engagement to an omnichannel experience

As an example, Canada’s CIBC embraced a third-party experience management solution that uses first-party cookies to help build a more scalable and relevant digital platform. This platform allows it to prioritize and push targeted mobile promotions to customers and synchronize data to create models that can update product pages quickly and at scale. The platform also enables the bank’s busy customers to set up direct deposit payments, request financial relief, or apply for credit card rate reductions or mortgage payment deferrals in seconds.

Result? Mobile conversion rates increased by 50% and website conversions more than doubled. Bank leaders have credited digital investments made in 2021 and a cloud-first strategy for CIBC’s adjusted year-over-year revenue growth of 7%.

Strengthen Data Capabilities

At the turf of a retail bank brand, is the data that CIOs and CMOs can defend and use to succeed in this competitive environment. Retail banks have access to huge transactional, behavioral, and financial data, which they can use to create profitable customer relationships and understand customer behavior. But the point is- are you investing in technological capabilities to harness this data for your advantage?

The enormous volume of customer data that is supplemented by information from data ecosystems and third parties can strengthen any incumbent brand to leverage this ability and drive customer engagement and revenue. Structuring and organizing data silos with a centralized repository, such as a customer data platform (CDP) can help in generating deeper customer insights. Retail banks can also leverage large volumes of internal data to gain customer insights and a competitive advantage against fintech.

Increase Impetus between Traditional Banking and Fintech

The staggered tech shift in last few years calls for an increased partnership between traditional retail banking and fintech. Technology can be a force multiplier for a traditional bank. Hitesh Sachdeva, Head of Startup Engagement, Innovation and investments at the ICICI Bank, India, emphasized, “We realize that innovation has two broad approaches. One is you keep building a lot of innovation inside the bank. But it has its own limitations. And the other way to capture the innovation is to tap into the innovation happening in the outside ecosystem, and amalgamate it inside the bank with platforms, partnerships, and collaborations with start-ups, to create innovative products, which are in alignment with our digital roadmap, for rapid prototyping experimentation and then make it the core of the bank.” So this way, fintech companies can play an influential role as the ‘enabler’ of traditional banks, rather than the ‘competitors’.

In a Nutshell

Banks can clearly deliver value by shifting from monolithic broadcasting models to engaging interactive service delivery of fluid experiences to customers. There has to be a shift from brand custodians to brand experience custodians. Bank 4.0 innovations can hence help shape a growth trajectory around four critical areas- product, customer experience, data, and technology.

The recipe for new-age digitization lies in a coherent and integrated strategy. Bank CMOs and CIOs keen on delivering personalized experiences to customers or orchestrating bank 4.0 innovation, can get in touch with the Valuebound product engineering team to learn how we can help to convert your revenues by turning customers into brand evangelists.