Globally, fintech companies raised more than $90 billion in the first three quarters of 2021, almost double the pace in 2020, with 42 new fintech unicorns minted in the third quarter alone, says McKinsey.

Finance as a sector includes financial service companies and fintech companies, and the sector juggernauts towards digital transformation with strategic technological trends. Before we dive into these trends, we must first understand what is fintech? Financial Technology, also known as FinTech, is described as the new technology which automates or improves the functioning of financial services. FinTech companies help the finance sector with better efficiency and delivery through algorithms, software, computers, and smartphones.

In our blog series on FinTech insights, we are going to discuss extensively about the FinTech trends shaping the industry. In this blog, we are going to discuss the challenges of the fintech industry in India and the technologies used to solve those challenges.

What challenged the status quo for FinTech Companies in India?

“Increased demand for inclusive financial services, customer expectations, and the business need to reduce costs while providing faster, safer, and more reliable services underpin the rise and growth of FinTech companies,” explains EY. So what challenges the status quo in the financial services sector?

- Firstly, more fintech companies want to be branded as digital-native in the FinTech landscape. This means that several services which traditionally were dependent upon human capital for loan disbursal, real-time payments, investment advisory, peer-to-peer lending, and other financial services, are automating tasks through one ‘Super App’.

- Secondly, there are now efficient and sleek offerings from FinTech companies, which help businesses in reducing costs and providing more customer-driven services.

- And thirdly, rising advancements in technologies like data science, automation, and AI/ML push traditional financial services companies towards a digital environment.

Current status of FinTech in Asia

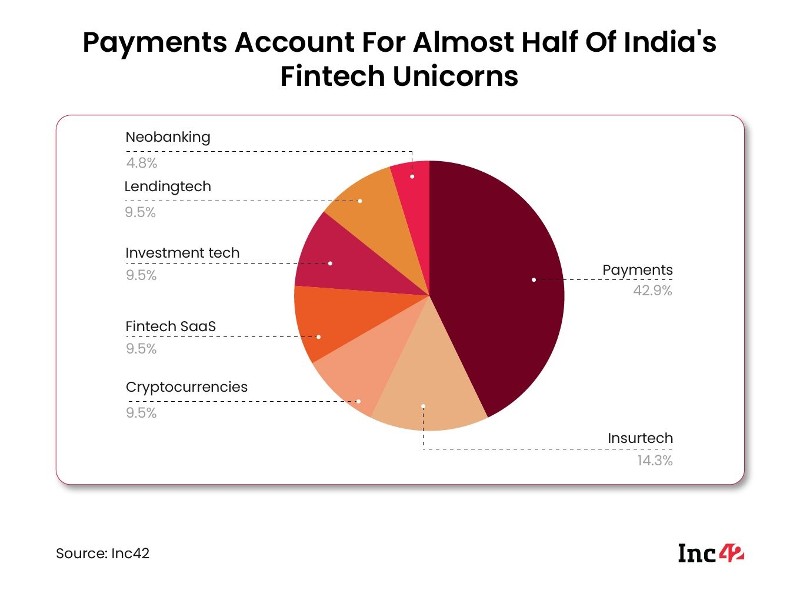

“People skipped the cards stage altogether in the Asia-Pacific market. Then newer technologies came in, mostly mobile-payment-based, a lot of wallet platforms. Basically, every single company that has a substantial number of consumers decided to start monetizing these consumers by providing payment applications that replace the need to use debit or credit cards,” says Arik Shtilman, CEO of FinTech platform provider, Rapyd (U.S.). This explains one of the most significant trends, i.e., payments accounting for almost half of India’s FinTech unicorns (42.9%).

Zeroing in at a granular level in Asia, if we speak specifically about India we see that country’s total fintech opportunity is set to rise to $1.3 Tn by 2025, according to Inc42’s State Of Indian Fintech Report, Q2 2022. There are 102 unicorns in India, and the latest entrant to the list is neo-banking FinTech start-up, Open. The total number of FinTech companies in India is 21. So what shifts are paving way for technology trends in the FinTech industry?

Large Shifts for FinTech Companies

Three shifts that are playing out across Asia, according to McKinsey Global Institute (MGI) research are:

- More consumers reaching the highest tiers of the income pyramid, and movement within the consuming class is likely to be a larger driver of consumption growth than movement into it,

- Cities driving consumption growth, but increasingly diverse cohorts within cities account for promising growth sources, and

- Relationship between income and consumption breaks down in some instances, new consumption curves are emerging in specific categories.

Sitting upon these shifts, there are 10 critical technology trends playing across the FinTech industry in India.

10 Technology Trends Driving FinTech Industry in India

- The Rise of SuperApp: FinTech, corporate giants, and BigTech are racing toward creating a one-stop shop for offering a comprehensive financial service platform.

- BNPL rewriting credit: Buy Now Pay Later has become a new buzz-phrase in the FinTech industry in India. It allows consumers to leapfrog credit cards, and directly get instant digital credit during purchase.

- InsurTech, a rising example of product innovation: Its digital distribution is making penetration of insurance products easier and accessible for consumers.

- Neobanks serving underserved or unserved customer segments: There is an increase in hyper-personalized banking services.

- WealthTech rise during COVID: This trend has transformed the investment environment of the country, and serves as a critical vertical in scaling-up new equity investors.

- API banking development: Embedded banking is helping each financial (or non-financial) company in adding FinTech as a strategic feature to enhance customer experience.

- MSME becomes a battleground for FinTech: Micro, Small & Medium Enterprises have shown massive acceleration towards the digital landscape, thus making it a ripe market for disruption.

- Digital Lending attracts most investors: This is the most-funded FinTech business model and is maturing further with an increased focus on collections.

- Digital Payment account for the biggest sub-sector: This sector continues drawing large funding, and has the most number of firms queuing for IPO. Major unicorns like PhonePe, Paytm, and BharatPe being heavily payment-focused (Fig. 1).

- Rise of Crypto: Bitcoin, Ethereum, digital tokens like NFTs, and digital cash rely heavily on blockchain technology. Despite becoming popular, the major hiccup in this sub-sector is regulation and compliance.

Road Ahead for FinTech in India

India’s FinTech journey is unique because governments, regulators, financial institutions, and FinTechs contribute collectively towards making the finance sector digital-native. Yet, the technological challenges and policy rails need to achieve and sustain higher growth for successful collaborations.

Strategic adoption of technology trends can lead to transformational evolution in the way financial services or products are delivered to end-users and helps in creating exceptional value for customers.

If you are facing a tech challenge in deploying a project or need a hand in starting a project, reach out to us to learn how Valuebound has successfully converted ideas into unique digital solutions through a team of creative product engineers and developers.