Even though APIs have become a common denominator of digitization over the past few years, only 30% of the FIs were actually using APIs as of early 2021, suggests PYMNTS. So where is the challenge? To explore the growth potential, C-suite executives must also be aware of the global open banking situation. In this article of three-part series on open banking, we explain the challenges and opportunities of adopting API banking business model.

Matt Naish, head of the product strategy at FISPAN, a fintech company offering differentiated banking experience, says, “the lack of integration, generally speaking, is not a technical problem. The problem is with change management and process management.” He adds statistics to emphasize that “50% of customer relationship management (CRM) implementations fail — not because of the software but because of the inefficiencies of layering new systems over legacy infrastructure.”

Deloitte in its 2021 report, Open banking: Unleashing the power of data and seizing new opportunities underscores that data sharing is among the most critical challenges of open banking. The wariness to share data lies not just at the bank’s end, but also among the customers. The report says that cybersecurity and data protection are the top concern areas across all age groups, followed closely by wariness towards third-party access to data and transparency on data usage.

About 70 percent of survey respondents feel that greater emphasis should be made on data protection by institutions. More than 80 percent of respondents (who include multiple Financial Institutions, including banks and FinTechs, and customers) are uncomfortable with sharing the transaction history of accounts hinting toward a need for all FIs to assure customers that their data is secure.

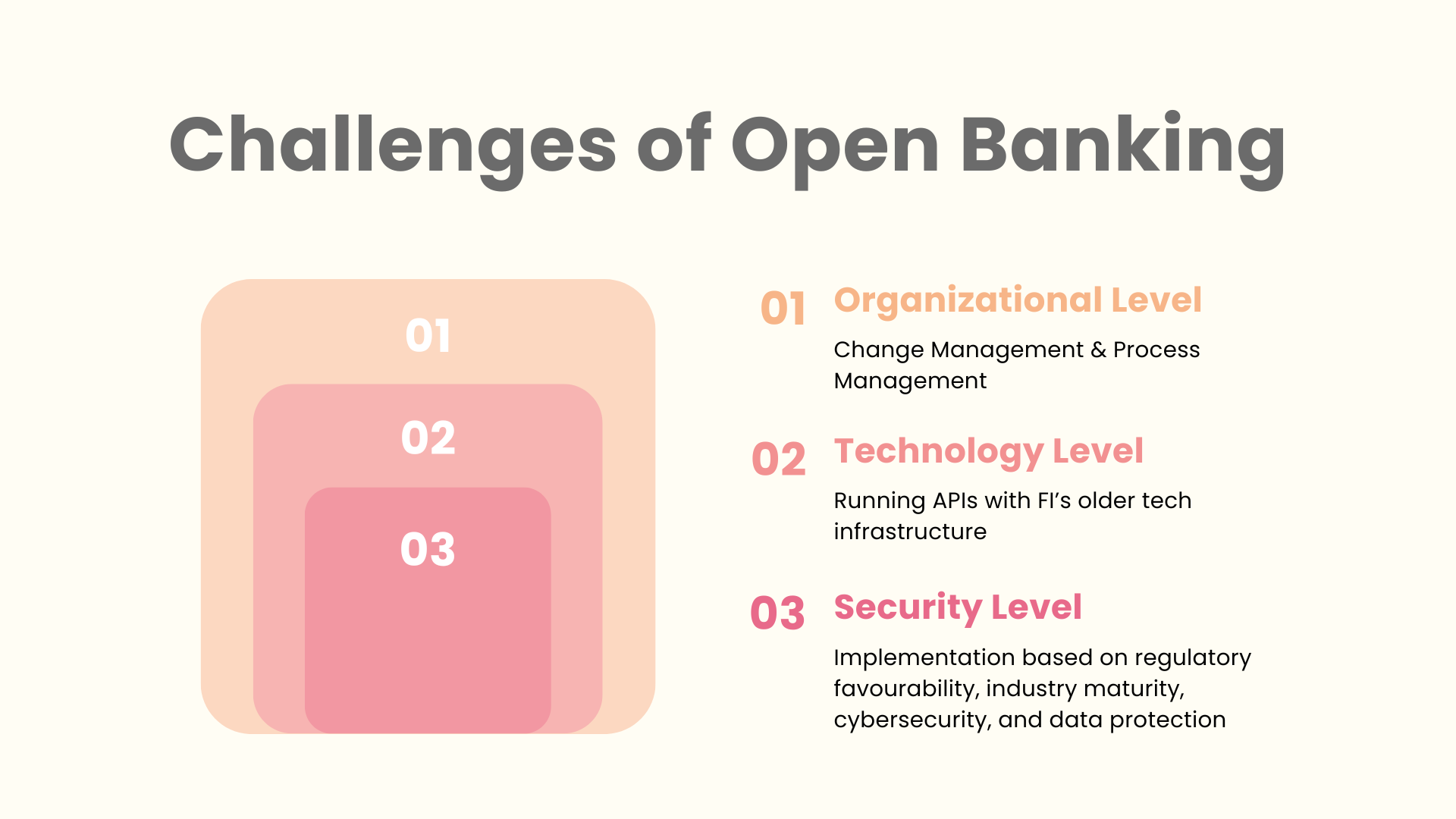

So, we can safely say that the critical challenges of open banking are across 3 areas (Fig. 1)

- At the organizational level: Change Management & Process Management

- At the technology level: Running APIs with FI’s older tech infrastructure

- At the security level: Implementation based on regulatory favourability, industry maturity, cybersecurity, and data protection.

Open Banking Scenario in India: Case Study

India’s open banking or API banking scenario stands on a hybrid foundation. The retail banking industry and the government have collectively been involved to fuel financial development, and at the heart of this is an ambitious project called India Stack- an initiative that comprises several APIs and is aimed at bringing developers, businesses, fintech start-ups, and government at a unified software platform.

India Stack is a set of APIs (Aadhaar, eKYC, UPI, Digilocker, and eSign) that allows governments, businesses, startups, and developers to utilize a unique digital Infrastructure to solve India’s hard problems towards presence-less, paperless, and cashless service delivery.

“We believe Open Banking represents the next “UPI moment,” opening up new capabilities empowered by data,” TCS’ Report suggests. The strategic imperative for banks will be to figure out the implications stemming from the widespread consent-driven sharing of financial information.

From an operational perspective, banks will need to invest in technology for evaluating and acting upon large volumes of diverse data.

Despite the anticipated marketplace shifts, banks are well positioned to deliver solutions with deeper functionality, especially in areas such as corporate and SME banking, which requires deeper, contextual financial advice and expertise beyond what fintechs, telecom companies, and technology firms can typically provide. In these specialist segments, banks will likely continue to thrive.

HSBC’s Open Banking APIs and ICICI’s API banking are two successful examples of open banking. While HSBC’s open banking APIs enable third parties to begin integrating their financial services into merchant’s applications, ICICI’s payment APIs enable the complete payment lifecycle from registration to making transactions, checking status, and de-registering.

The Road Ahead

There are different ways in which financial services companies can approach the adoption of API banking or open banking. One way is to build APIs in-house, or they can also buy APIs and then bring them in-house. The second way is to integrate with platforms and partners like Valuebound.

A collaborative model can help banks future-proof their technological pursuits, given that it is still hard to say where the banking industry will go in a decade or half from here. By engaging with platforms and partners, FIs get an opportunity to position themselves for growth in real-time data exchange, embedded banking, and real-time payments.

Partnering with a product engineering company reduces a traditional organization’s time to market by adopting an agile product development and deployment. If you wish to spin off a successful, agile, cost-effective digital operation, get in touch with us to learn how we can accelerate your business model towards API banking or open banking.

In the next insight of our three-part series, we shall talk about the key tenets of open banking that form the pillars of a successful open banking ecosystem and a market-ready strategy for implementing an open banking business model by solving the challenges mentioned in this insight.